You know, most people scroll past money talk because it feels complicated or just not fun. But honestly, managing money is one of those things everyone wishes they understood better. They’re just waiting for someone to break it down simply.

Social media gives you a chance to show up for people, not just as a financial advisor but as someone they trust to help them figure things out step by step.

If you’re stuck thinking, “What should I even post that doesn’t sound salesy?” don’t worry.

I’ve pulled together some social media post ideas for financial advisors that feel real, relatable, and easy to create. Let’s make people feel like they’re learning from a friend, not a financial textbook.

15 Social Media Post Ideas for Financial Advisors

1. Money Tip of the Week

A little money wisdom goes a long way. Every week, share a small yet powerful money tip. Nothing fancy, just the kind of advice you’d give a friend over coffee, like reminding folks how setting up auto-transfers to savings can change the game.

These bite-sized tips help your audience learn without feeling overwhelmed. It’s like nudging them toward better money habits one post at a time.

Check this post by Vivian Tu, a former JP Morgan equities trader. It’s simple, friendly, and straight to the point. See how they casually share the tip in a way that feels like it’s coming from a friend who genuinely wants to see you win with money.

2. Myth vs. Fact Series

There’s so much financial misinformation floating around. You can use your platform to tackle one myth at a time, like “Renting is throwing money away”, and explain why that’s not always true.

People love seeing facts laid out simply. It builds trust and gives them clarity. Share your honest take to make it feel like a conversation, not a lecture.

3. Client Wins / Success Stories

Real stories from real people make the most impact. Share those small but mighty client victories with their consent, like how Sarah paid off her student loans or how Ali bought his first home. These moments remind people their goals are possible.

These stories make you relatable and show you care. It’s not just about numbers. It’s about the real impact financial planning can have.

Read Blog Post:

4. Financial Jargon Explained

Pick one term people hear all the time, like “compound interest” or “diversification,” and explain it like you’re chatting with a friend. Keep it simple and use a story or example.

When people finally understand the term, they’ll remember you as the one who made it click, not some confusing article online.

5. Market Update – Keep it Simple

Market updates don’t have to be stuffy or full of jargon. Share what’s happening in plain English. For example, explain why interest rates are changing and how that could affect someone’s mortgage.

When you break it down simply, people see you as someone they can actually talk to about money. That’s how trust grows.

6. Behind-the-Scenes or Day in My Life

People love seeing the human side of professionals. Show them your workspace, coffee breaks, or even the chaos of balancing meetings and family. It makes you more relatable.

It reminds your audience that behind the spreadsheets is a person who genuinely cares about helping them get ahead in life.

7. Financial Book or Podcast Recommendation

If you come across a podcast episode or a book that hits home, share it. Tell people why it’s worth their time and what one takeaway stuck with you.

It positions you as someone who’s always learning and wants others to grow, too. It also sparks great conversations in the comments.

8. Polls and Quick Questions

Once in a while, throw out a fun poll or a quick question. People love giving their opinions. Ask about their biggest savings goal this year or what confuses them most about investing.

It opens up conversations and helps you see what’s on people’s minds. It makes your page feel interactive, like a real community, not just random posts.

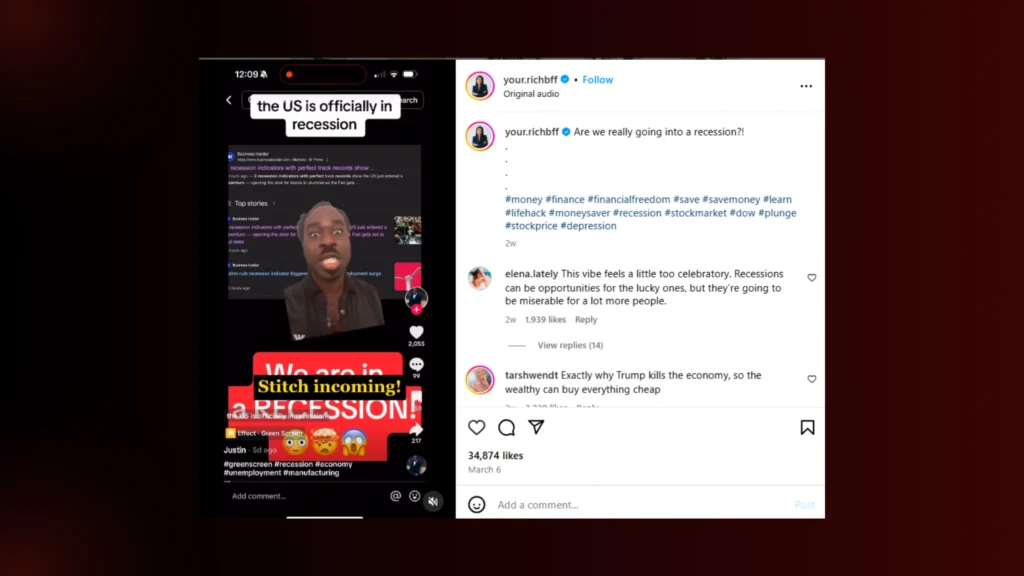

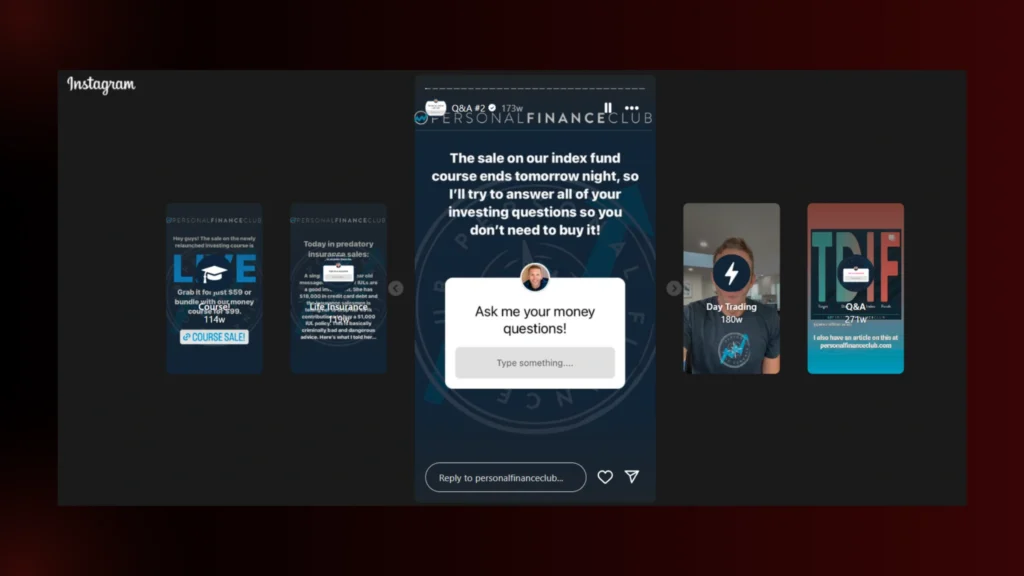

For example, Jeremy often uses Instagram Stories Q&A to invite followers to ask about money.

See his Q&A highlight below.

9. Personal Story or Lesson Learned

Nothing beats honesty. Share a money mistake you’ve made and what you learned from it. Whether it was not saving enough or missing an investment opportunity, people love seeing your human side.

It builds credibility because you’re not just preaching. You’ve lived through the same challenges your audience is facing.

For example, Jeremy shared a post where he opened up about spending $64,110 on Amazon over the years.

He admitted that most of that money probably went toward stuff that is now sitting in a landfill. Instead of hiding this regret, he turned it into a valuable lesson by explaining how he would rather invest that money to buy freedom and cover his cost of living.

You can do the same!

10. Financial Goal Planning Checklist

People love lists. Give them a simple checklist for something like starting an emergency fund or maxing out their 401(k). Break it down into small steps they can actually follow.

It feels good ticking off boxes, and you’re setting them up for small wins. Downloadable templates or graphics make this super shareable.

11. Seasonal Reminders (Tax Time or Year-End Planning)

Pop in with helpful reminders when deadlines creep up, like tax season or open enrollment. A gentle nudge goes a long way in keeping your audience on track.

They’ll appreciate you looking out for them, especially when everyone’s juggling a million things at once.

12. FAQ Series – Answer Common Questions

Gather the questions you get all the time, like “Do I need life insurance if I’m single?” and answer them casually, like you’re talking to a buddy.

People feel heard when their concerns are addressed directly. It’s a great way to show you understand what’s stressing them out financially.

13. Celebrating Small Wins or Client Milestones

It doesn’t have to be a huge life event. Celebrate the small wins, too. Paid off a credit card? Finally, opened that investment account. Give those moments a shout-out.

It shows that progress is progress, no matter how small. People feel seen, and it motivates others to take action, too.

For example, Your Rich BFF shared a post celebrating a huge moment for her platform after being featured in an article.

She thanked the journalist for giving her the chance to share what they’ve been building and talked about her plans to make personal finance accessible to everyone. It was not just a win for her but also a motivational moment for her audience.

14. Throwback – How You Started

Share your own journey. Talk about what inspired you to become a financial advisor, where you struggled, and what you’ve learned. Everyone loves a good backstory.

It reminds your audience that you’re not just about numbers. You’ve got heart experience, and you’re still learning and growing.

15. Finance and Life – Relatable Memes or Quotes

Throw in a meme or a funny quote about money. Everyone needs a laugh when budgeting. Something like, “Why is it that payday and bill day are the same day?”

It keeps your page light, relatable, and human. People are way more likely to engage and share when they see themselves in your posts.

Read Blog Posts:

- 10 Social Media Campaign Ideas That Drive Engagement

- What are the solutions to social media problems

- 8 Social Media Disadvantages Every Business Should Know

FAQs

1. Can Financial Advisors Post on Social Media?

Yes, and honestly — they should. Social media is where people go for advice these days, even about money. Sharing helpful tips, common mistakes, or explaining tricky topics in simple words can really help people.

Of course, it’s important to stay mindful of compliance rules, but showing up online builds trust — and that matters.

2. How Do I Advertise Myself as a Financial Advisor?

The best way? Teach, don’t sell. Share what you know — talk about common money mistakes, simple budgeting tips, or things you wish more people understood about finances.

When people see your content helping them (without pushing services right away), they naturally start trusting you. And honestly, trust is your best advertisement in this field.

3. What Is the Best Social Media Platform for Financial Advisors?

It really depends on who you want to reach:

- LinkedIn works well if your clients are business owners or professionals.

- Instagram is great for breaking down money topics into short, easy-to-digest posts or reels.

- YouTube or even TikTok is perfect if you enjoy talking through ideas or sharing stories.

Go where your audience is — and where you feel comfortable showing up consistently.

Wrapping it up

The truth is people want to understand their money. They’re just waiting for someone to show up and make it simple. Social media gives you the perfect chance to educate, connect, and build trust without feeling salesy.

If creating content still feels overwhelming or you’re not sure where to start, Brand ClickX is here to help. We work with financial advisors like you to build content strategies that actually attract leads and turn followers into clients.